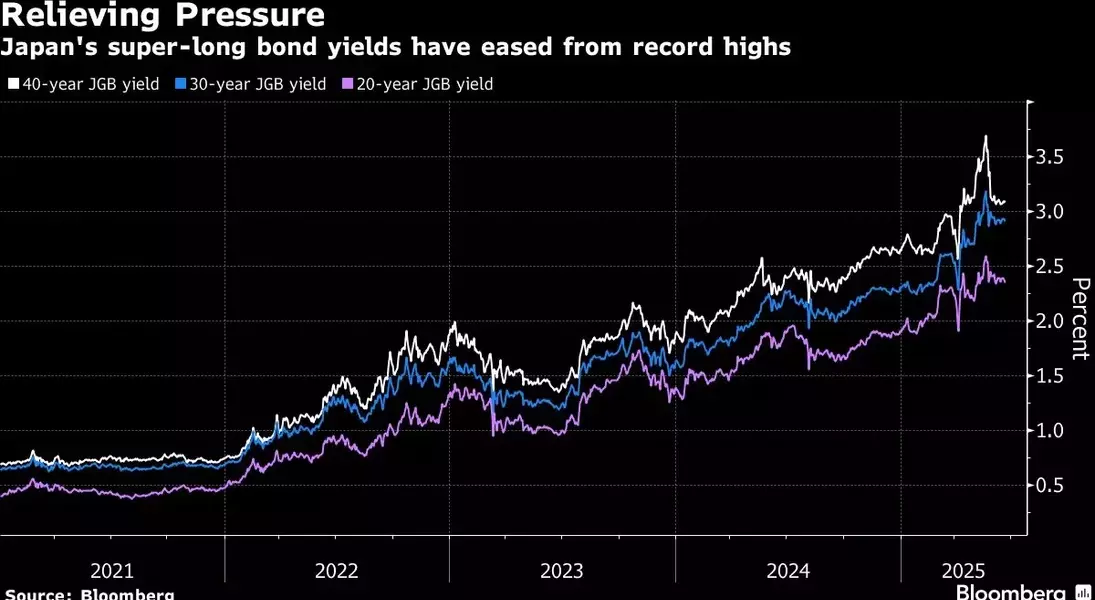

Japan's Ministry of Finance has announced a significant reduction in the issuance of super-long bonds, aiming to mitigate upward pressure on yields ahead of an upcoming auction. This strategic move comes at a critical time as tensions escalate in the Middle East, potentially affecting oil prices and inflation rates. Analysts suggest that this adjustment may help stabilize trading in the key sector of long-term government bonds, despite challenges posed by rising consumer prices and anticipated increases in government spending due to an upcoming election.

The revised plan includes substantial cuts in 20-, 30-, and 40-year bond sales totaling ¥3.2 trillion ($22 billion) through March next year. Although this initiative is seen as a calming factor for the market, it also shifts some issues to shorter-dated debt issuance. Experts weigh in on the potential impact of these changes on market stability and liquidity, emphasizing the importance of strong demand in upcoming auctions for longer-term bonds.

Strategic Reductions in Super-Long Bonds

The Japanese government has decided to strategically reduce the issuance of super-long bonds, focusing primarily on 20-, 30-, and 40-year maturities. This decision aims to address immediate concerns about market volatility and ensure smoother trading conditions. The cut exceeds earlier projections, with a particular emphasis on 20-year bonds, which experienced poor reception during the last auction. By adjusting supply levels, authorities hope to clarify the direction of demand and improve overall market conditions.

This significant reduction in super-long bond issuance stems from recent challenges faced by Japan's debt market. A poorly received auction last month highlighted vulnerabilities in this segment, prompting swift action from policymakers. The ministry's proactive approach seeks to prevent further volatility while addressing external factors such as geopolitical tensions impacting oil prices and inflation. Analysts believe that by making these adjustments sooner rather than later, the government can enhance stability in upcoming auctions scheduled for June and July. However, questions remain regarding whether increased demand will sufficiently address lingering liquidity issues.

Impact on Shorter-Term Bonds and Market Dynamics

While reducing super-long bond issuance, Japan plans to increase the supply of shorter-term bonds. This shift could introduce new complexities into the market, potentially offsetting some benefits gained from stabilizing longer-term securities. Officials acknowledge that while buybacks might be beneficial, implementing them poses challenges related to market autonomy. As a result, current efforts focus on fine-tuning issuance levels across different maturities to maintain balance within the broader financial ecosystem.

In response to evolving market dynamics, the Bank of Japan has also signaled intentions to slow its withdrawal from the market starting next year, reinforcing efforts toward maintaining stability. Detailed adjustments include cutting 40-year bond issuance by ¥0.5 trillion, reducing 30-year bonds by ¥0.9 trillion, and slashing 20-year bonds by ¥1.8 trillion. Conversely, there are plans to boost shorter-term issuances, including increasing 2-year bonds by ¥0.6 trillion and raising 6-month bonds by ¥1.8 trillion. Overall, total bond issuance to the market will decrease slightly by ¥500 billion for the fiscal year. These moves collectively aim to navigate through uncertainties arising from both domestic and international fronts, ensuring sustainable growth and resilience in Japan's financial landscape.