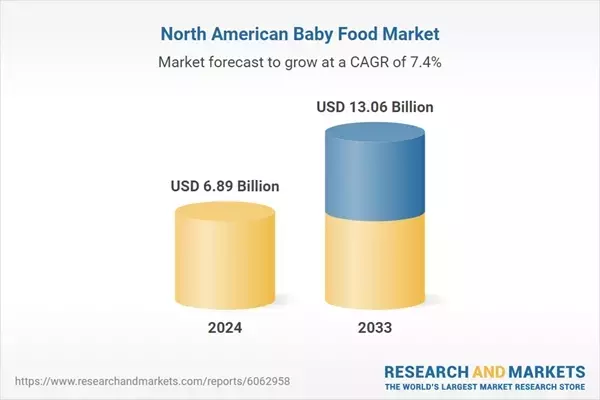

The North American baby food market is experiencing substantial growth, driven by increasing consumer demand for healthier, organic, and innovative infant nutrition options. Projected to reach a value of $13.06 billion by 2033, the market is anticipated to grow at a compound annual growth rate (CAGR) of 7.37% from 2024 to 2033. This expansion is fueled by factors such as heightened parental awareness of early childhood nutrition, advancements in product formulations, and the rise of e-commerce platforms that cater to modern parenting needs. Key players in the industry are actively responding to these trends by introducing premium, clean-label products and expanding their distribution channels.

In recent years, there has been a marked shift towards organic and non-GMO baby food products. Parents are increasingly concerned about the presence of pesticides and artificial additives in traditional baby food offerings. As a result, companies have responded by developing fortified foods enriched with essential nutrients like iron, DHA, and probiotics, which support brain development and digestion. Ready-to-eat pouches and organic cereals have become particularly popular due to their convenience for on-the-go families. Additionally, plant-based and allergen-free alternatives are gaining traction, further diversifying the market landscape.

This trend is exemplified by brands such as Sprout Organics, which recently expanded its product line with co-branded items featuring characters beloved by children across North America. These new offerings include veggie-packed purees and nutritious snacks crafted from authentic organic ingredients, enhancing mealtime excitement for young ones. Moreover, pediatrician recommendations promoting balanced diets and allergen-free products have bolstered the popularity of plant-based and dairy-free baby food solutions.

The digital age has also revolutionized how parents purchase baby food. E-commerce platforms, subscription services, and direct-to-consumer models provide unparalleled convenience, allowing caregivers to explore diverse product selections and tailor feeding plans to their infants' specific needs. For instance, a mom-founded pediatric nutrition brand introduced a grass-fed whole milk infant formula in late 2024, emphasizing high-quality, domestically sourced ingredients. Such innovations not only expand choices for U.S. parents but also uphold rigorous safety standards.

Despite this promising outlook, the industry faces challenges related to regulatory compliance and safety concerns. Stringent guidelines imposed by authorities like the FDA and USDA require manufacturers to adhere to stringent quality and labeling requirements. Issues surrounding heavy metals in baby food have intensified scrutiny, compelling companies to enhance testing protocols and accountability measures. While larger corporations can absorb these costs, smaller brands may struggle to meet these demanding expectations, potentially hindering their growth potential.

As the North American baby food market continues to evolve, it remains clear that consumer preferences for natural, nutritious, and accessible products will drive its trajectory over the coming decade. Companies that successfully navigate regulatory hurdles while delivering innovative solutions will likely dominate this burgeoning sector. The forecast period underscores an era of transformation where technological advancements and shifting priorities converge to shape the future of infant nutrition.