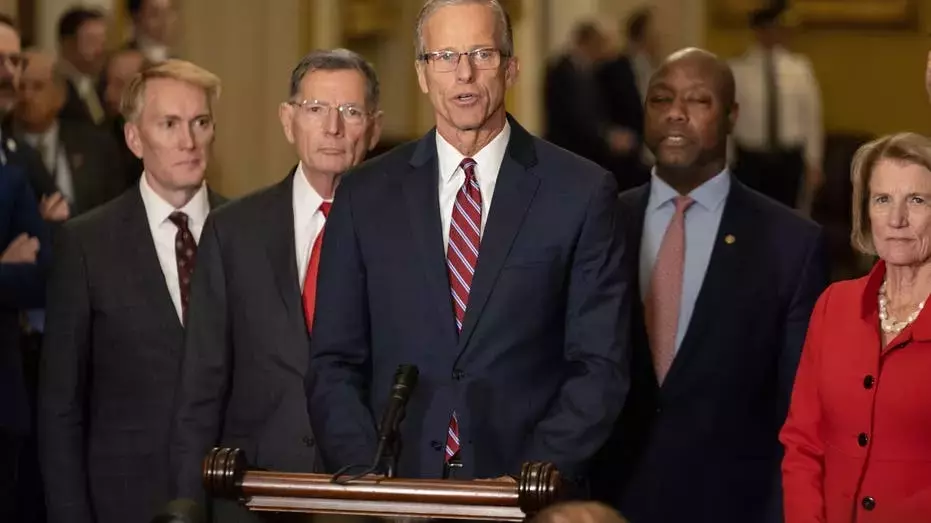

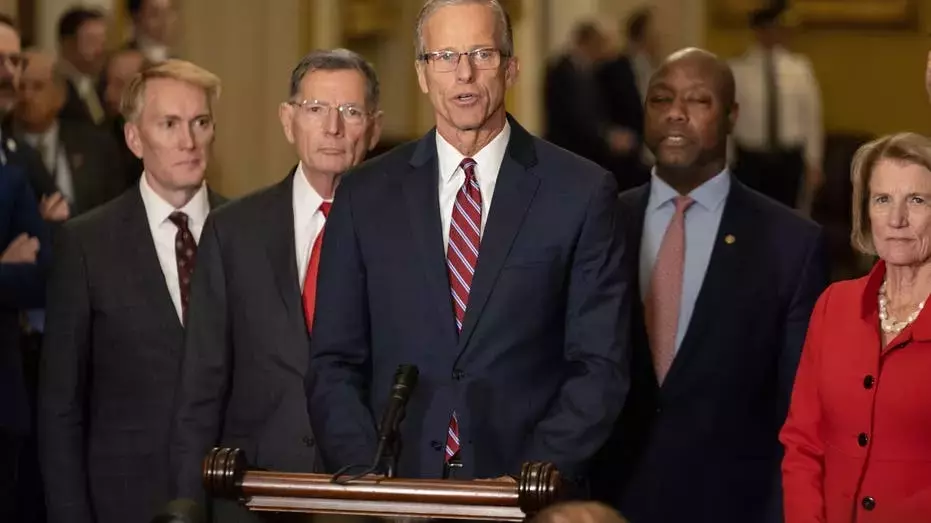

In an effort to fulfill President Donald Trump's promise of a major tax reform package, Senate Republicans have introduced their chamber's version of the GOP tax cuts and extensions plan. This proposal aims to prevent a potential $4 trillion tax hike at the end of the year when temporary provisions from the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire. The legislation seeks to make several key TCJA changes permanent, including adjustments to tax brackets, standard deductions, and new deductions for tips, overtime, and car loan interest. These measures aim to ease financial burdens on American taxpayers and households.

Details of the Senate GOP Tax Proposal

During this pivotal legislative moment, Senate Republicans have unveiled a draft aimed at solidifying long-term tax relief. In the vibrant political climate of Washington D.C., lawmakers are working diligently ahead of the Fourth of July deadline. Under the proposed bill, the current lower tax rates established by the TCJA would become permanent, avoiding a return to higher rates in 2025. For example, the income brackets would remain at 10%, 12%, 22%, 24%, 32%, 35%, and 37% rather than reverting to previous levels such as 39.6%.

The standard deduction, another cornerstone of the TCJA, is also addressed in the Senate bill. For single filers, it would increase from $15,000 to $16,000 in 2026, while married couples filing jointly would see their deduction rise from $30,000 to $32,000, with subsequent inflation adjustments.

A notable feature of the bill includes introducing new deductions for individuals who regularly receive tips, allowing them to deduct up to $25,000 annually. Similarly, employees earning overtime could deduct up to $12,500, provided their compensation is reported separately on W-2 forms. Furthermore, taxpayers could benefit from a deduction of up to $10,000 for qualified passenger vehicle loan interest, applicable to vehicles assembled within the United States.

These provisions, however, are not permanent and would require future legislative action beyond 2028.

From a journalistic perspective, this tax proposal reflects a strategic move by Senate Republicans to address both immediate fiscal concerns and broader economic stability. It underscores the importance of thoughtful policy-making that balances budgetary constraints with taxpayer relief. As debates continue, it remains to be seen how these measures will influence public sentiment and economic growth in the coming years. Such initiatives highlight the ongoing dialogue between government and citizens regarding equitable taxation and financial security.